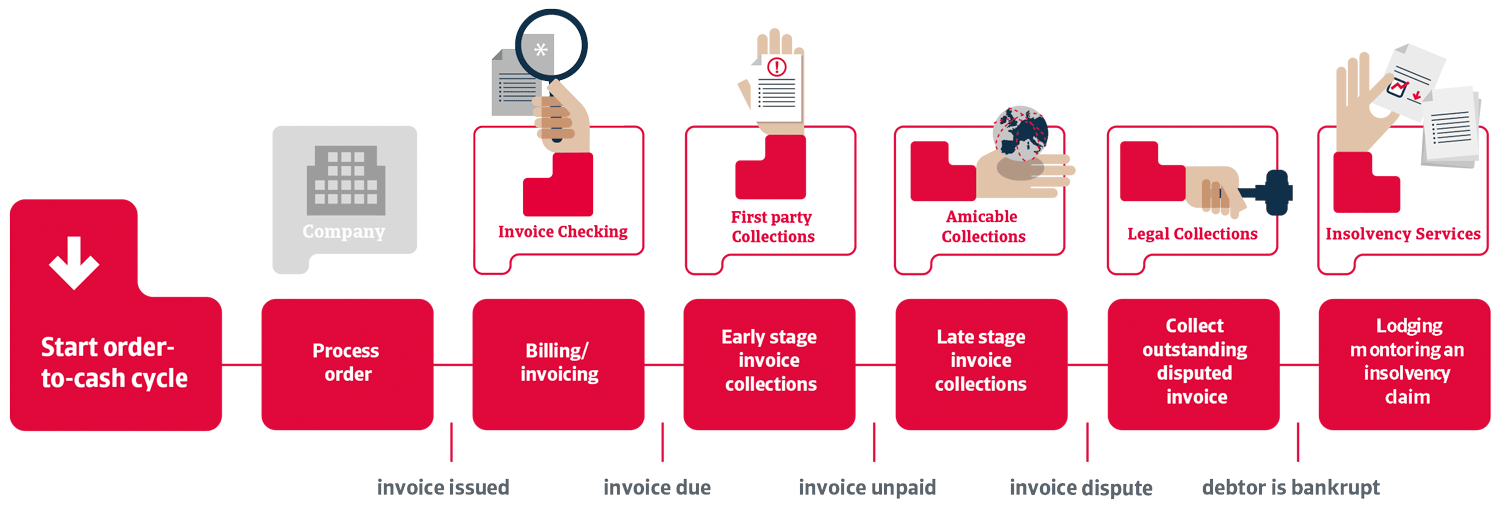

Our Invoice Checking service is designed to support factoring companies by helping them to scrutinise invoices, including looking into the commitment and ability of the customer to pay.

Atradius Invoice Checking: providing support to factors

Invoice Checking is a simple and cost effective way for a factoring company to investigate the business transactions and invoices presented by clients or prospective clients.

The circumstances in which, as a factor, you may wish to verify invoices include:

- Examination of invoice integrity prior to offering credit to a supplier

- An on-going invoice audit programme to check invoices raised by clients

- A review of the receivables portfolio to assess a client’s credit management process

Invoice Checking provides valuable information on the status of an invoice and signals a warning when receivables are disputed or goods are undelivered.

Mitigating global trading risks

As part of the global network at Atradius Collections, our Invoice Checking service applies to transactions and invoices in 96% of the world.

The use of Invoice Checking will support you in:

- Invoice fraud prevention

- Increasing the capability to finance or take risk on client portfolio

- Enhancing the risk mitigation process and minimising operational losses

- Security in financing international trade

Managing your account online

Our globally integrated online invoice software, Collect@Net gives you access to the latest status updates and reports on your financed portfolio. In addition to ease of use, with 24/7 accessibility, Collect@Net enables you to upload batch files complete with contacts and receive status updates about invoices being checked.

Disclaimer