Through our Governance Principles, Customer Service Charter and investment in innovation, we’re committed to leading our people and customers to better products and services than anywhere else.

Governance Principles

Atradius acknowledges the importance of good corporate governance. The Governance Principles that were drawn up by the Dutch Association of Insurers outline principles for Dutch insurance companies in terms of corporate governance, risk management, audit and remuneration and are applied by Atradius. Also, the Management Board undersigned the Declaration on moral and ethical conduct.

Declaration on moral and ethical conduct

Leading customer focus

At the heart of our operation is our customer focus. We are proud to lead the sector in this area. For example, we were the first to introduce Global services targeted at the unique needs of multinational organisations.

Today our customer-centric leadership can be seen in our Customer Service Charter, where we commit to the highest levels of customer service and response.

Our customer focus is also a key part of our strategy. Our strategic goals include creating sustainable revenue growth and increasing profits. Ultimately we believe that we will only be successful if our customers and stakeholders are successful too. So we aim to achieve these goals by ensuring that our customers and stakeholders receive the best possible service and support from us.

I’m very glad that Atradius involved us as a customer in the development of this tool. You often only need to understand which five or ten per cent of information you really need to focus on, and this tool helps me to do that.

Leading through innovation

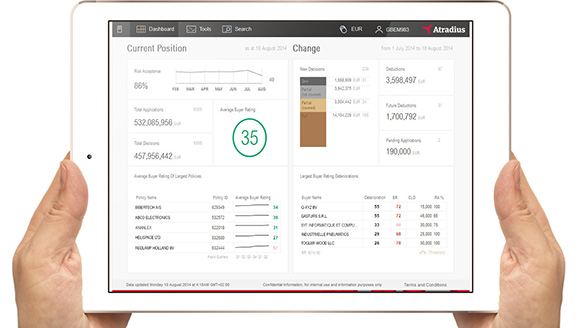

Our dedication to developing the best tools to support our clients makes us world leaders in credit insurance innovation. Our commitment to innovation is a key area of our operational strategy. Our latest tool, Atradius Insights, sets a new standard within the credit insurance industry for credit management.

At Atradius, we want to go beyond credit insurance. We want to provide our customers with insight into their risk. As an online business intelligence tool, Atradius Insights allows clients to identify current and future risks and monitor portfolio performance. This includes drill down options from a main dashboard to provide in depth levels of detail, sophisticated filter options and the ability to export selected data.

Specific tools include the ability to show all credit limit decision issued during a selected timescale distributed across your customer ratings bands. It also provides you with an overview of any credit limit decisions that may be scheduled to expire or be withdrawn within the next 12 months.

Leading industry voices in our Management Board

Atradius represents much more than insurance. We build personal relationships with our customers and their buyers to better understand their businesses and provide a more detailed insight into their credit risks.

They’re recognised among their peers as leading voices in the credit insurance sector, with several having worked their way through the business and understanding it in great detail from the ground up.

Goals and strategy

At the heart of our strategy is a desire to create an enduring business with sustainable revenue growth and a secure, stable increase in profits which comprehensively meets our stakeholder and customer needs, irrespective of the size or scope of their business.

The focus of our operation is on credit insurance and other affiliated credit management services, such as recoveries and collections. Within this, our goal is to expand in three main areas:

- Customers: from all three key segments - global/multinational companies, large companies and SMEs

- Markets: by continually exploring new opportunities in emerging markets, particularly in Central and Eastern Europe, Asia and the Americas

- Products: by investing in and designing new products and services which target needs specific to each market segment

In addition to a customer-focus and commitment to innovation, our strategy is to strengthen our competitive position and reduce profit volatility, through maximising cost efficiencies.