Cheques have been in use for over 350 years, with so many alternative ways to pay it is a surprise that cheques are still used today!

With so many alternative ways to pay it is a surprise that cheques are still used today. Cheques have been in use for over 350 years, and although there were signs that they were to be phased out for example in the UK the idea was scrapped.

For many companies cheque is still the way to go

However, cheques also provide a way to delay payments. Even if your customer does not mean to delay payments, if you are paid by cheque it is useful to know how long you may be waiting until the funds have cleared. It may just change your mind about accepting cheque as a way to pay.

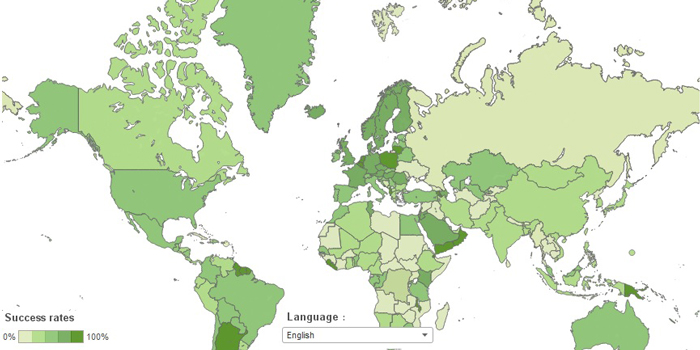

Use our interactive map to see how long you could be waiting for cleared funds if you accept a cheque payment from a foreign country. It could be anywhere up to 56 days!