As a company, it's important that you assess your receivables for risks. Learn factors you should be paying attention to with this guide.

In our risk assessment guide we show you in 7 easy steps how you can manage your account receivables. For example, calculating your DSO or considering your debtors creditworthiness can help in projecting a clearer picture. By identifying which default risks arise from the overall structure of your company’s accounts receivable could lead to improvement and success.

Download the Risk Assessment Guide.

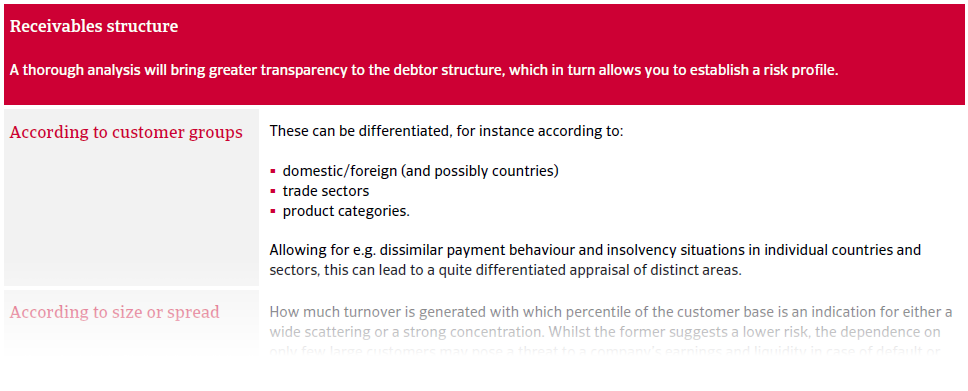

1. Receivables structure

Analyze the receivables structure and establish a risk profile according to customer groups, size and spread

Preview:

2. Potential exposures

Pay attention to potential exposures by evaluating debtor security arrangements and potential insolvency repercussions.

3. Past bad debts

Evaluate past bad debts to identify inefficiencies in your accounts receivables management and determine default risks.

4. Days of Sales outstanding (DSO)

Calculate the days of sales outstanding (DSO) to further assess the efficiency of your receivables management.

5. Future risks

Take future developments into consideration when assessing your debtor’s creditworthiness.

6. Terms of payment

Establish or adjust payment terms to meet your company’s requirements.

7. Credit manager qualifications and skills

Ensure the presence of qualified credit managers and employees for more successful management of receivables.

Download the full Risk Assessment Guide.