The proportion of domestic and foreign past due B2B invoices in Taiwan (domestic: 42.7%; foreign: 47.2%) is almost in line with the regional averages.

With China as its main trading partner, Taiwan is one of the Asian countries most affected by the deceleration in China’s GDP growth. Despite a minor increase in GDP growth in 2017, external demand is expected to remain rather weak. In order to manage the risks stemming from the slowdown, 54.2% of respondents stated that they will increase creditworthiness checks and 47.1% that they will increase their use of credit insurance.

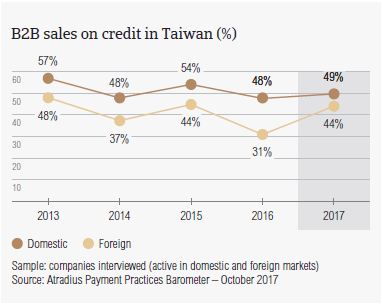

Sales on credit terms

There was a steep increase in the percentage of B2B sales on credit terms in Taiwan, from 39.2% in 2016 to 46.4% in 2017. This was the biggest year-on-year increase observed in the Asia Pacific region.

- On average, 48.9% of the Taiwanese suppliers’ sales to their domestic B2B customers was on credit. This is slightly higher than the percentage reported in 2016 (47.8%).

- A more significant increase was registered in respect to foreign customers. The average percentage of foreign B2B sales made on credit by Taiwanese respondents increased from 31.1% in 2016 to 43.8% in 2017.

- Despite the increased percentage of foreign B2B sales on credit, Taiwanese suppliers, like their peers in the Asia Pacific region, are more averse to selling on credit to their foreign than to their domestic B2B customers.

- Following the above-mentioned increases, Taiwan was one of the countries most inclined to sell on credit, with a percentage of B2B sales on credit slightly higher than that registered at regional level (45.9%).

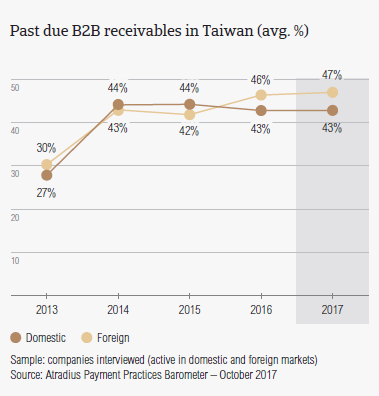

Overdue B2B invoices (%)

Respondents in Taiwan reported late payments from their B2B customers less frequently than one year ago and the proportion of past due receivables seems to be flattening out.

- The percentages of respondents who have reported late payments from their B2B buyers in Taiwan (domestic: 88.0% and foreign: 84.1%) are lower than those for Asia Pacific overall (domestic: 89.6% and foreign: 88.8%) and have decreased compared to 2016 (domestic: 91.9%, foreign: 91.3%).

- Similarly to what was observed in 2016, the proportion of foreign past due B2B invoices was higher than that of domestic past due B2B invoices.

- On average, 42.7% of domestic invoices remained unpaid at the due date. This percentage shows a small decrease when compared to 2016 (42.9%). In respect to foreign overdue B2B invoices, these increased from 45.7% in 2016 to 47.2% this year.

- The country’s proportion of domestic and foreign past due B2B invoices is almost in line with the regional average (domestic: 44.6%; foreign: 46.1%).

- The average Days Sales Outstanding (DSO) figure recorded in Taiwan is 42 days. Taiwan’s average DSO is two days longer than the DSO figure for Asia Pacific overall and has not changed compared to 2016.

- Looking at the coming 12 months, 40.9% of respondents in Taiwan said that they do not expect changes in their average DSO. However, 29.8% of respondents foresee a slight increase and 18.7% expect a slight decrease.

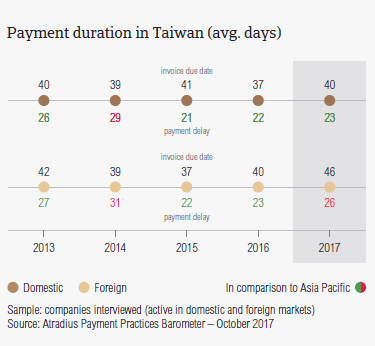

Payment duration (average days)

In 2017, both domestic and foreign B2B customers of respondents in Taiwan enjoyed longer payment terms than one year ago. Payment delays have been reported to have increased slightly.

- Domestic B2B customers of suppliers in Taiwan had, on average, 40 days to settle their invoices. Three days longer than in 2016.

- The average payment terms for foreign B2B customers were 46 days in 2017. Six days longer than in 2016.

- Payment delays from both domestic and foreign B2B customers increased in 2017. Domestic B2B customers of respondents in Taiwan delayed payments, on average, by 23 days (2016: 22 days). Foreign B2B customers delayed payments, on average, by 26 days (2016: 23 days).

- Due to the changes in average payment terms and payment delays, suppliers in Taiwan needed longer to turn B2B receivables into cash. In 2017, the payment duration in Taiwan averaged 68 days, four days longer than in 2016 and 13 days longer than the payment duration for Asia Pacific overall.

Key payment delay factors

Respondents in Taiwan said that the main reason for domestic payment delays was insufficient availability of funds. Foreign B2B customers of respondents in Taiwan seem to delay payments most frequently because of the complexity of the payment procedure.

- 46.8% of respondents in Taiwan said that domestic payment delays occurred mainly because of insufficient availability of funds. This is also the main reason for payment delays reported in Asia Pacific overall, although the regional percentage of respondents reporting this is slightly lower at 43.8%. The second most reported reason for payment delays by domestic B2B customers in Taiwan is disputes over the quality of goods delivered and services provided (reported by 34.8%). At regional level, the second most reported reason was the complexity of the payment procedure (27.4%).

- The top two reasons for payment delays by foreign B2B customers in Taiwan are the complexity of the payment procedure (reported by 39.1% of respondents) and inefficiencies of the banking system (35.3%). At regional level: the complexity of the payment procedure (34.9%) followed by insufficient availability of funds (33.3%).

- Late payments caused a loss of revenue for 15.0% of respondents in Taiwan. Moreover, 30.6% of respondents in the country said that they needed to take specific measures to correct cash flow and 27.5% that they needed to pursue additional financing.

Protection of business profitability

Respondents in Taiwan are some of the most inclined in the Asia Pacific region to increase their use of credit management practices to protect themselves against risks stemming from Brexit, US protectionism and the slowdown in Asia.

- 36.0% of respondents in Taiwan (30.3% at regional level) plan to increase their use of credit management tools in the face of the above-mentioned developments. This is slightly lower than the percentage of Taiwanese respondents who stated that they will make no changes in their credit management practices (39.4%).

- The preferred credit management tools are increasing checks on buyers’ creditworthiness (stated by 44.4% of respondents), increasing credit risk monitoring (40.8%) and increasing their use of credit insurance (37.3%). These are the same tools as those reported at regional level.

- Respondents in Taiwan believe that the slowdown in Asia is impacting their businesses the most. To increase protection against risks stemming from this development, 54.2% of respondents said that they will increase checks on buyers’ creditworthiness and 47.1% that they will increase their use of credit insurance.

- To manage potential risks stemming from US protectionism, Taiwanese respondents intend to increase creditworthiness checks and their monitoring of their buyers’ credit risk (39.0% of respondents opted for each of these credit management tools).

- To increase protection against risks stemming from Brexit respondents in Taiwan will increase creditworthiness checks (39.9%) and increase monitoring of their buyers’ credit risk (37.4%).

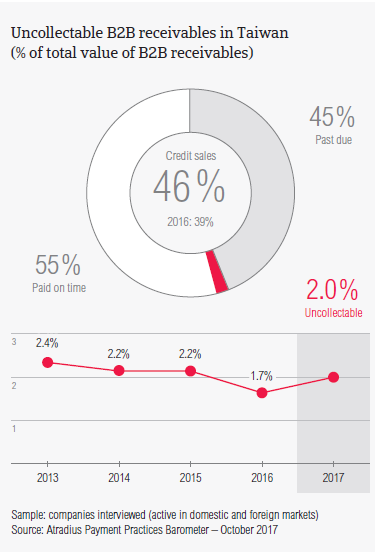

Uncollectable receivables

In 2017, minor increases in both domestic and foreign write-offs have been reported. As a result, the total value of B2B receivables written off as uncollectable in Taiwan increased from 1.7% in 2016 to 2.0% in 2017.

- Similarly to what was observed in previous surveys, in 2017, domestic receivables were written off as uncollectable more often than foreign ones (domestic: 1.4%; foreign: 0.6%). Compared to 2016 (domestic: 1.3%; foreign: 0.4%), minor increases have been observed.

- he total value of uncollectable receivables in Taiwan is almost in line with the averages reported at regional level (domestic: 1.5% and foreign 0.6%).

- Uncollectable receivables in Taiwan originated most often from B2B customers in these sectors: electronics, services, chemicals and consumer durables.

- Respondents in Taiwan reported that the main reasons why B2B receivables were uncollectable were: the customer going bankrupt or out of business (reported by 45.3%), the old age of the debt (35.8%) and invoices being disputed (31.1%).

Payment practices by industry

Looking ahead, more respondents in Taiwan seem to expect a slight improvement than deterioration in the payment behaviour of their B2B customers over the coming 12 months.

- Respondents in Taiwan granted B2B customers in the paper and construction sectors the longest payment terms (on average, 65 and 50 days respectively). This is much longer than the 43 days average for the country overall.

- In contrast, B2B customers in the transport and food sectors were asked to settle their invoices the fastest. They were asked to pay, on average after 21 and 29 days respectively.

- Respondents in Taiwan reported that in 2017, the slowest paying customers were those in construction materials and business services (in both these sectors, customers paid on average 33 days late) and those in the electronics sector (on average, 32 days late).

- According to survey findings the main reason for payment delays by domestic and foreign B2B customers was insufficient availability of funds. This was reported by 46.0% of Taiwanese respondents in construction materials, by 56.0% of respondents in business services and by 54.0% of respondents in the electronics sector.

Related documents

3.37MB PDF