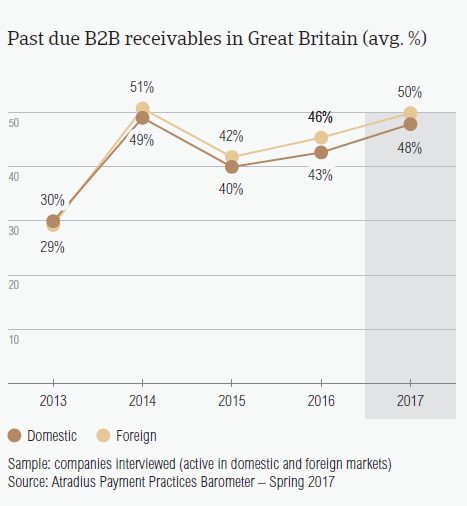

In 2017, the percentage of domestic and foreign past due B2B receivables in Great Britain saw an upswing. This follows a slight increase in 2016 and seems to underline an upward trend.

In 2017, Atradius Group conducted research studying corporate payment practices within the B2B sector in the UK. During the study, 217 companies were interviewed and questioned about how they experienced payment of receivables from their foreign and domestic customers. One of the main conclusions drawn from the research was that the volume of overdue B2B invoices continues to increase steadily.

Main results on the overdue B2B invoices (%) in the UK

- British respondents reported late payments from their domestic and foreign B2B customers (87.9%) less frequently than one year ago (91.1%). The decrease seems to be a result of fewer late payments by overseas customers (86% in 2017, down from 92% in 2016).

- More than half of the invoices of respondents in Great Britain were not paid by the due date (49%). This is four percentage points higher than in 2016 and higher than the 41% regional average.

- While in 2016, the increase in late payments was mostly a consequence of late foreign payments, in 2017, the trend appears to have reversed with more late payments by domestic B2B customers.

- Late payment of invoices (domestic and foreign) is reflected in the Days Sales Outstanding (DSO) figure posted by British respondents. This averages 31 days (survey average: 44 days) and is four weeks less than last year.

- Looking forward, most British respondents (61.3%) do not expect a change in their average DSO over the next 12 months and 20.1% expect a slight increase.

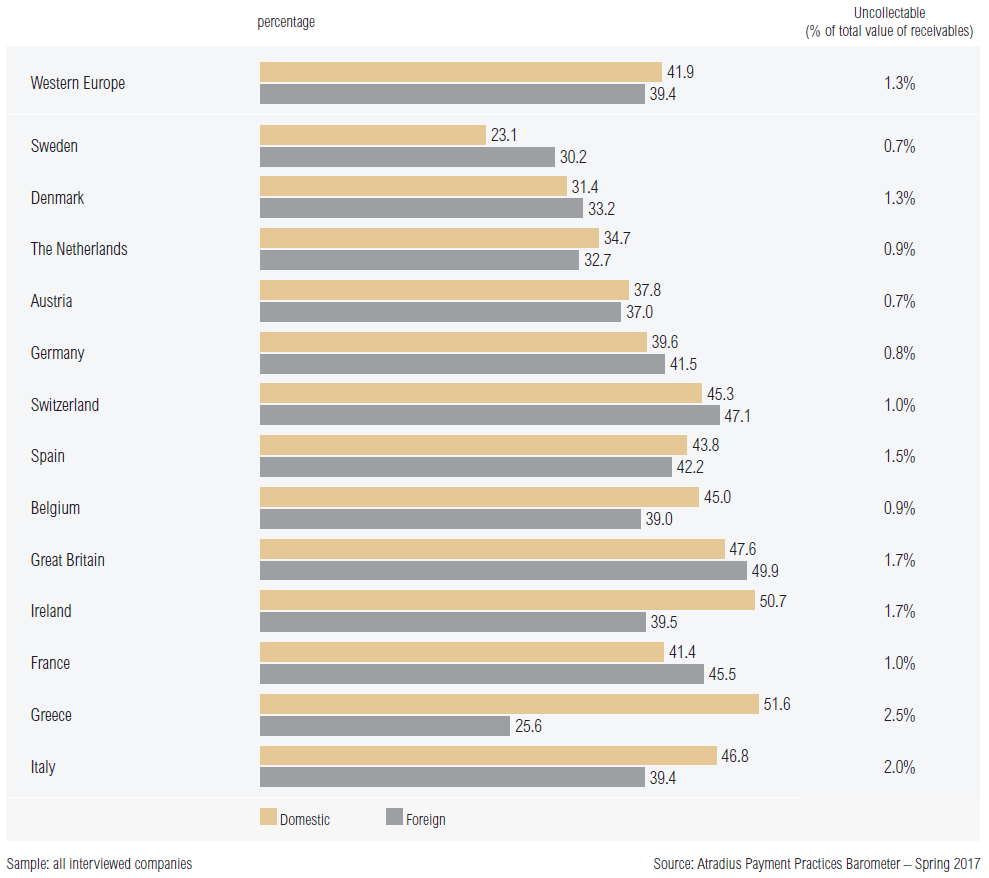

Western Europe: proportion of domestic and foreign overdue B2B invoices