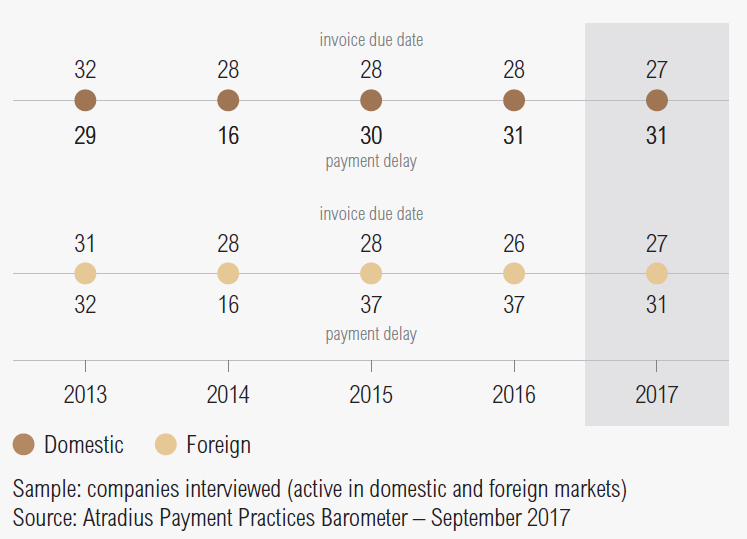

At regional level, the average payment duration is 61 days in 2017. This follows a shortening of the average payment terms and a modest decrease in payment delays in most of the countries surveyed.

Payment duration (average days)

- In 2017, payment terms granted by respondents in the Americas averaged 27 days (2016: 27 days).

- Average payment terms in Mexico (36 days) and Brazil (32 days) are longer than the regional average.

- Mexico offered the most lenient payment terms in the region. The average payment term given to domestic B2B customers was 35 days (33 days in 2016), while foreign B2B customers needed to settle their invoices, on average, within 36 days (32 days in 2016).

- With the exception of Mexico, all countries surveyed in the Americas saw a decrease in domestic payment delays.

- In respect to their foreign B2B customers, all respondents in the Americas (with the exception of Brazil) reported an increase in payment delays in 2017.

- Based on the above-mentioned changes, respondents in Canada have the shortest average invoice to cash turnaround (around 53 days), and respondents in Mexico the longest (75 days).

Source: Payment Practices Barometer US 2017

Key payment delay factors

The most often cited reason for payment delays among B2B customers of respondents in the Americas remains insufficient availability of funds.

- Domestic B2B customers of respondents surveyed in the Americas delayed payments most often due to insufficient availability of funds (41.8%), and their buyers’ intentional use of outstanding invoices as a form of financing (28.2%). While the main reasons for domestic payment delays were consistent with those of Europe (insufficient availability of funds: 55.5%; buyers’ intentional use of outstanding invoices as a form of financing 30.3%), the response rate for insufficient availability of funds was much higher in the Americas.

- Foreign B2B customers of respondents in the Americas most often delayed payments because of the complexity of the payment procedure (cited by 29.7%) and insufficient availability of funds (28.3%). The main reason for foreign payment delays in Europe was insufficient availability of funds (34.1%), followed by the complexity of the payment procedure (28.2%).

- Canada (48.6%) and Mexico (40.8%) are the countries most impacted by late payments due to domestic customers’ insufficient funds. Foreign payment delays driven by liquidity issues were reported most often in the United States (29.7%) and Canada (28.7%).

Source: Payment Practices Barometer US 2017