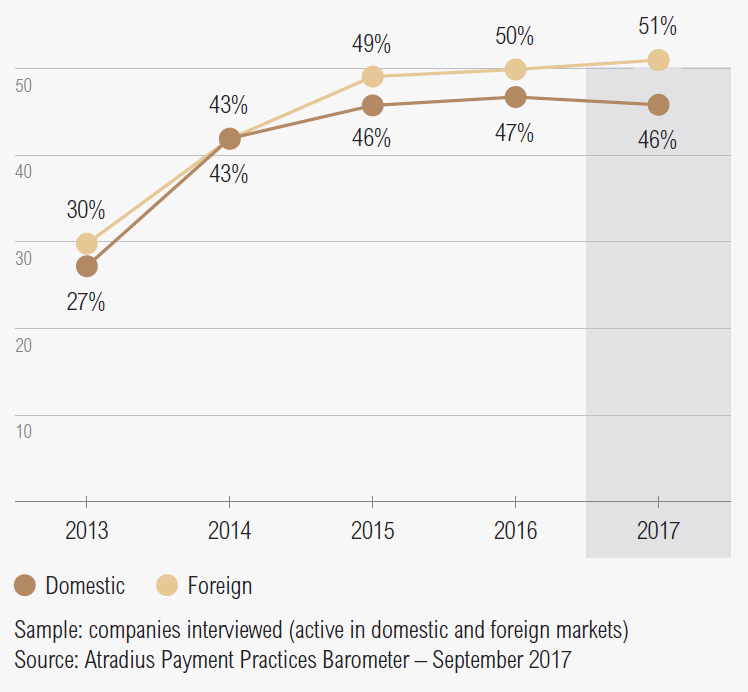

After a minor increase from 47.6% in 2015 to 48.4% in 2016, the percentage of overdue B2B invoices appears to be flattening out, rising to 48.8% in 2017.

Overdue B2B invoices (%)

- 92.6% of respondents in the Americas (2016: 95.0%) reported late payments from their domestic B2B customers. An average of 46.2% of the proportion of domestic invoices, remained unpaid at the due date.

- The frequency of late payments from foreign B2B customers decreased slightly from 91.0% in 2016 to 90.0% this year. In contrast, the proportion of foreign invoices that remained unpaid at the due date increased slightly from 50% in 2016 to 51.4% this year.

- The average frequency of late payments to respondents was highest in the United States (domestic 96.2%, foreign 94.0%) and lowest in Canada (domestic 88.7%, foreign 86.1%).

- Similarly to what was observed in previous surveys, Mexico seems to be the country most impacted by late payments of invoices; 54.8% of the total value of domestic and 56.0% of the total value of foreign invoices were paid late. This is also reflected in the country’s DSO figure, which averaged 47 days and is significantly higher than the regional average of 35 days.

- The percentage of overdue B2B invoices is higher in the Americas (48.8%) than in Europe (41.1%).

Source: Payment Practices Barometer US 2017

Protection of business profitability

25.9% of respondents in the Americas plan to do more to protect their businesses from the impact of Brexit, the slowdown in Asia and US protectionism. This is a significantly higher percentage than that registered in Europe (15.5%) and may highlight the respondents’ perception that they are more exposed to the risks arising from these developments.

- Similarly to what was observed in other regions surveyed, the majority of respondents in the Americas (41.7%) reported that they will make no changes in their current mix of credit management tools.

- On average, 31.9% of respondents in the Americas reported their intention to increase checks on buyers’ creditworthiness and 28.2% to increase monitoring of buyers’ credit risk in the face of the above-mentioned developments. These were also the two credit management tools most reported in Europe, although the percentages were significantly lower (20.0% and 17.4% respectively).

- Although most worried about US protectionism, respondents in the Americas seem to opt for the same management tools to protect themselves against Brexit (increasing creditworthiness checks: 29.6%; increasing credit risk monitoring: 26.2%), the slowdown in Asia (increasing creditworthiness checks: 30.9%; increasing credit risk monitoring: 27.6%) and US protectionism (increasing creditworthiness checks: 35.3%; increasing credit risk monitoring: 30.8%).

Source: Payment Practices Barometer US 2017