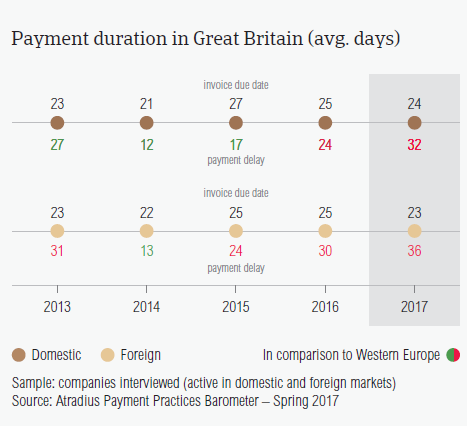

B2B trade credit payment terms extended by British respondents average 23 days from the invoice date and are the shortest across the Western European countries surveyed.

- Compared to one year ago, payment terms granted to domestic B2B customers (24 days) appear to be, on average, one day shorter. Payment terms granted to foreign B2B customers (23 days) are also shorter this year, on average, by two days.

- The strong emphasis on swift invoice payment observed in Great Britain was also seen in Denmark, Germany and the Netherlands (average payment terms: 24 days), and Austria (25 days).In 2017, there was a decrease in the speed of payment from both domestic and foreign B2B customers.Domestic B2B customers paid on average, 32 days from the invoice date – eight days later than in 2016.

- Similarly to what was observed in 2016, foreign B2B customers had longer payment delays than domestic B2B customers. The average foreign payment delay stood at 36 days from the invoice date (2016: 30 days).

- Despite the shorter DSO, which may suggest invoices of higher value being collected faster, British respondents’ invoice to cash turnaround increased to an average of 57 days from 52 days last year.

Source: Payment Practices Barometer UK 2017